30+ Bi monthly mortgage calculator

About the bi-weekly mortgage payment program and whether its an effective way to own your home faster. You may also enter 360 months for a 30-year loan or 15 years for a 15-year fixed or 180 months depending on loan type desired.

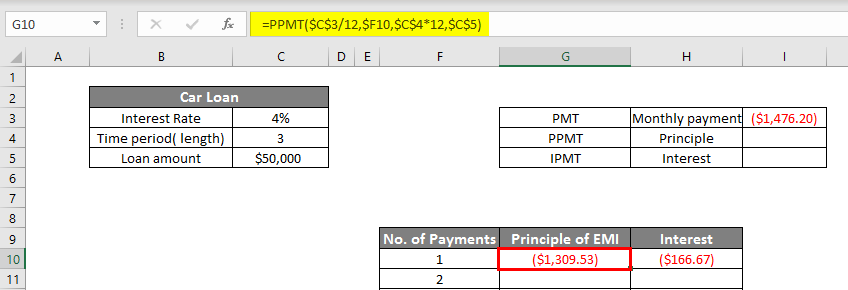

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Scotiabank Mortgage Calculator allows you to calculate your mothly mortgage payments and cash required for real estate purchases using current Scotiabank rates.

. Our calculator includes amoritization tables bi-weekly savings. For simplicitys sake use the same 200000 loan amount and 30-year. Check out the webs best free mortgage calculator to save money on your home loan today.

Lock-in Redmonds Low 30-Year Mortgage Rates Today. And an irregular extra payment. Community State Bank 802 E Albion St.

For most conventional loans youre required to pay for private mortgage insurance PMI along with your monthly mortgage payment until. By sending 1300 to your lender monthly youll overpay your mortgage by. Estimate your monthly payments with PMI taxes homeowners insurance HOA fees current loan rates more.

To use the early payoff mortgage calculator simply enter your original loan amount when you first received the loan along with the date you took out the home loan. Filters enable you to change the loan amount duration or loan type. This bi-weekly mortgage calculator has more features than most - includes extra payment and printable amortization table to plan your interest savings.

With this unique 4 column format you can compare scenarios side-by-side print amortization schedules and. Compare lenders serving Redmond to find the best loan to fit your needs lock in low rates today. But much less interest is paid over time vs 30-yr loans.

The biweekly payment calculator has the option to include PMI property tax and home insurance which will make the interest savings even bigger. Say your home loan APR is 6 then the interest rate for a month will be 6. Typically the term or length of a commercial mortgage can be anywhere from 1-10 years with limited exceptions for longer terms on self-amortizing loans such as SBA loans up to 25 years insurance or Fannie Mae loans up to 30 years or FHA loans up to 35 years for refinance or 40 years for construction to permanent financing.

The following chart shows how much you can save by making extra biweekly payments worth 50 or 200 on your mortgage. Using my Mortgage Payoff Calculator Extra Payment. This presumes youre making bi-weekly payments at the start of your loan.

To the monthly mortgage and turbo charge your interest savings. 30-Year Fixed Mortgage Principal Loan Amount. Following is a list of options that the biweekly mortgage calculator includes some of them are optional fields.

How much money could you save. Also offers loan performance graphs biweekly savings comparisons and easy to print amortization schedules. By default 250000 30-yr fixed-rate loans are displayed in the table below.

Annual Interest Rate APR. This free mortgage calculator helps you estimate your monthly payment with the principal and interest components property taxes PMI homeowners insurance and HOA fees. Payment Frequency - Monthly Bi-weekly not only can you calculate bi-weekly but you.

It also calculates the sum total of all payments including one-time down payment total PITI amount and total HOA fees during the entire amortization. But it can be also bi-monthly quarterly and yearly. By the end of each year you will have paid the equivalent of 13 monthly payments instead of 12.

Then enter the loan term which defaults to 30 years. Those who might sell within 7 years. For mortgage loan it is normally 15-30 years.

A mortgage calculator is a smart first step to buying a home because it breaks down a home loan into monthly house payments based on a propertys price current interest rates and other factors. The Mortgage Payment Calculator allows you to calculate monthly payments average monthly interest total interest and total payment. Biweekly Mortgage Calculator.

The most common terms for mortgages are 15 years and 30 years. Annual Interest Rate you will pay for your loan. The calculator allows you to enter a monthly annual bi-weekly or one-time amount for additional principal prepaymentTo do so click Prepayment options.

How to Use the Mortgage Calculator. Biweekly payments accelerate your mortgage payoff by paying 12 of your normal monthly payment every two weeks. Our mortgage calculator reveals your monthly mortgage payment showing both principal and interest portions.

Free 9 Sample Payroll Calendar Templates In Pdf Excel

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

How To Create A Biweekly Budget In 5 Simple Steps Clever Girl Finance

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Excel Pmt Function With Formula Examples

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

/what-are-differences-between-delinquency-and-default-v2-dfc006a8375945d4b63bd44d4e17ffaa.jpg)

Delinquency Vs Default What S The Difference

Laboratory Budget Template 3 Things You Need To Know About Laboratory Budget Template Today Budget Template Monthly Budget Template Budget Template Free

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Free Biweekly Timesheet Template Excel Pdf Word

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed